LAWMAKERS DEBATE MORE OF THOSE

(UNNECESSARY) OIL AND GAS REGS

The House Energy, Environment and Natural Resources Committee considered two bills today to slap more regulations on the goose that lays the golden egg. Both are sponsored by Committee Chair Matthew McQueen (D-Sandoval and Santa Fe). The first, House Bill 257, a measure to control well transfers, was rolled over at the sponsor’s request in order to work out amendments that might remove some opposition. The second, House Bill 258, a bill to codify rules governing flaring and natural gas releases, was passed by the committee on a 7-4 partisan vote, D’s in favor and R’s opposed.

HB 257

HB 257 seeks to give the Oil Conservation Division (OCD) the authority to probe into the financial records of private companies to determine if they have the financial capacity to close wells at the end of well life when the wells are being transferred from one set of owners to another. The goal is to reduce the number of abandoned and orphaned wells, which require the state to step in and complete closure. The OCD can place conditions on the transfer or block the transfer entirely.

Terri Cole, President and CEO of the Chamber, had this to say:

“We understand the legitimate interest the state has in minimizing the number of orphaned or abandoned wells that could potentially become a taxpayer burden. However, putting the state in the position of prejudging winners and losers is never a good idea. This bill would especially work a hardship on small, independent producers who extract the maximum value from wells that contribute significantly to state and local treasuries and provide hundreds of jobs. Also, the open-ended requirement for up-front financial assurance simply may hinder small operators from acquiring wells, thereby reducing production. We urge a “no” vote on HB 257.”

Rep. Mark Murphy (R-Chaves), himself an independent oil producer, drilled down on this bill. One of Murphy’s main concerns was authorizing the OCD to obtain confidential information that could become public through the Inspection of Public Records Act (IPRA). Ben Shelton, legal counsel for the New Mexico Energy and Minerals Department, of which OCD is a part, said there are exemptions from IPRA but that he’d have to research if those apply in this situation. Murphy also pointed out that producers pay a fee for abandoned well closures that goes into an OCD fund. According to Murphy, last year the fund was at a balance of $137 million and only $27 million was spent, leaving a current balance of $110 million. He questioned why this wasn’t enough to take care of the abandoned and orphaned wells, all paid for by the industry, not state taxpayers.

Proponents argue that they’re trying to head off more problems by stopping ownership transfer up front that are being proposed by “bad actors” or those lacking the financial resources to ensure subsequent well closing. They also said that much of the OCD fund for well closures has been diverted to the general fund. In other words, the producers aren’t getting what they paid for. Supporters of the legislation include the Western Environmental Association, New Energy Economy, Earthcare, Environmental Defense Fund and the Center for. Biological Diversity.

Speaking on behalf of the New Mexico Oil and Gas Association and in opposition to HB 257 was Ashley Wagner. She emphasized that this bill sets a dangerous precedent, interjecting the state government into private property sales and transfers, allowing OCD to dictate to whom and under what circumstances transfers can be made. . This sentiment was reflected by other Oil and Gas producers, including the Independent Petroleum Producers Association and the Permian Basin Petroleum Producers Association. McQueen requested the bill be rolled over to address some of the opposition concerns.

HB 258

This bill proposes to codify existing OCD rules regarding flaring and releasing natural gas. However, it turns out it isn’t quite that simple. Because of the language in the bill, several representatives, including Rep. Rod Montoya (R-San Juan) and Mark Murphy (R-Chaves) assert that pneumatic equipment would be prohibited, placing at least half of the operators in noncompliance immediately on the bill becoming law. Pneumatic equipment is needed because electricity is not available at many well sites, and running generators would contribute to increased air pollution. The sponsor does not believe the bill would terminate the use of such equipment and that the bill merely codifies existing rules. The committee gave the bill a “do-pass” recommendation on a straight partisan 7-4 vote, D’s for, R’s against.

Terri Cole had these observations:

“As we read the legislation, this bill codifies what’s pretty much in OCD rules already. Chiseling those rules into statute reduces the ability to adapt to changing technology and operating conditions. The industry has been very successful at capturing natural gas, and we have every reason to believe that innovation will continue, as it improves profitability.

“This seems to us to be a solution in search of a problem and potentially puts a heavy regulatory thumb on the scales that should balance regulation versus innovation. Inflexible or excessive regulation can be job killers, to say the least. This bill’s purpose appears to be more of a way to protect existing rules against the possibility of changes by a future administration than it does solving an obvious problem.”

Support for the measure came from environmental organizations, while opposition came from the oil and gas industry and business organizations. According to the industry, 88% of operators have achieved the goal of a 98% level of gas capture. Venting and flaring have been reduced by 77% since 2018 even though production has increased. The bill heads to the House Judiciary Committee next.

STRATEGIC WATER ACT EKED ITS WAT TO NEXT STOP

Although nearly every member of the House Agriculture, Acequias and Water Resources Committee voiced serious concerns about portions of the amended House Bill 137, Strategic Water Supply Act, sponsored by Reps. Susan K. Herrera (D-Rio Arriba, Sandoval, Santa Fe & Taos) and George K. Muñoz (D-Cibola, McKinley & San Juan), it’s on its way to the House Energy Committee. The bill is a priority of Gov. Michelle Lujan Grisham, who is seeking to establish a strategic water plan and fund.

Chamber President and CEO Terri Cole testified in opposition to HB 137 when it first appeared before the committee (it was rolled then as the sponsors worked to craft amendments to assuage opponents):

“The Chamber generally supports the goal of creating a strategic water supply in order to improve the state’s drought resilience and for use in developing green energy. However, we’re concerned about what the funding mechanism will be and that it will place a tax on our oil and gas production. Therefore, we reluctantly must oppose HB 137 at this time.”

Joining the Chamber in opposition this morning were Acoma Pueblo, the Independent Petroleum Association of New Mexico, the New Mexico Oil and Gas Association, the Permian Basin Petroleum Association, Defend New Mexico Water, New Energy Economy, the Center for Biological Diversity and numerous others online. Concerns about the burden HB 137 will place on the oil and gas industry, if the tax is even constitutional, as well as the reliability of the science behind and the safety of produced water dominated the comments.

As we have written before, it’s not every day that you see environmental advocates and businesses stand in opposition to the same bill.

To recap with the amended language, the funding to figure out how to use produced and brackish water for industrial purposes, thereby saving fresh water, would come from a new, now 3-cent-per-barrel tax, on produced water from the oil and gas industry. (Produced water rises to the surface as a result of drilling oil wells. About 60% of produced water is used for fracking wells, often with chemicals added.)

And while Herrera and her expert witness from the Governor’s Office are correct, that “there’s no snow on the mountains (and we need to work to) preserve every kind of water we can get,” there’s no equity in placing the financial burden solely on the backs of our oil and gas industry. There are questions about the release of toxic materials from produced water and the lack of scientific evidence that there is a feasible way to treat the water while still protecting groundwater and, more generally, the environment.

And there are the concerns, voiced by Rep. Randall Pettigrew (R-Lea), that no other state has assessed such a tax, and by Rep. Marian Matthews (D-Bernalillo), that enough progress can be made under this administration to justify the tax and the investment given that the next governor could scrap it. Pettigrew said he knows of one producer who will be hit with an $8 million tax bill as a result of HB 137. The Permian Basin Petroleum Association testified the 3-cents-a barrel tax will rake in $82 million annually.

Despite the majority of committee members expressing the opinion HB 137 is “putting the cart before the horse,” it received a 5-4 “do-pass” vote along party lines, with Rep. Angelica Rubio (D-Doña Ana) joining Republicans because she said she can’t philosophically support produced water.

HB 137 has three committee assignments, a tough slog. Should it make it through House Energy, it will then head to House Appropriations and Finance.

TOURISM HELPS DRIVE N.M. ECONOMY

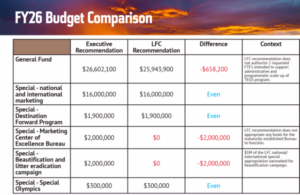

The New Mexico Tourism Department presented in the Senate Finance Committee today; the executive budget is recommending more than the Legislative Finance Committee, and the accompanying graphic breaks down where the differences are:

The executive budget includes around $600,000 more for Tourism in the coming fiscal year compared to LFC’s, with that funding focused on additional staff. The department has also established a Marketing Center of Excellence Bureau to streamline the state’s marketing across departments (the bureau is codified in statute) and is continuing with the governor’s anti-littering campaign as well.

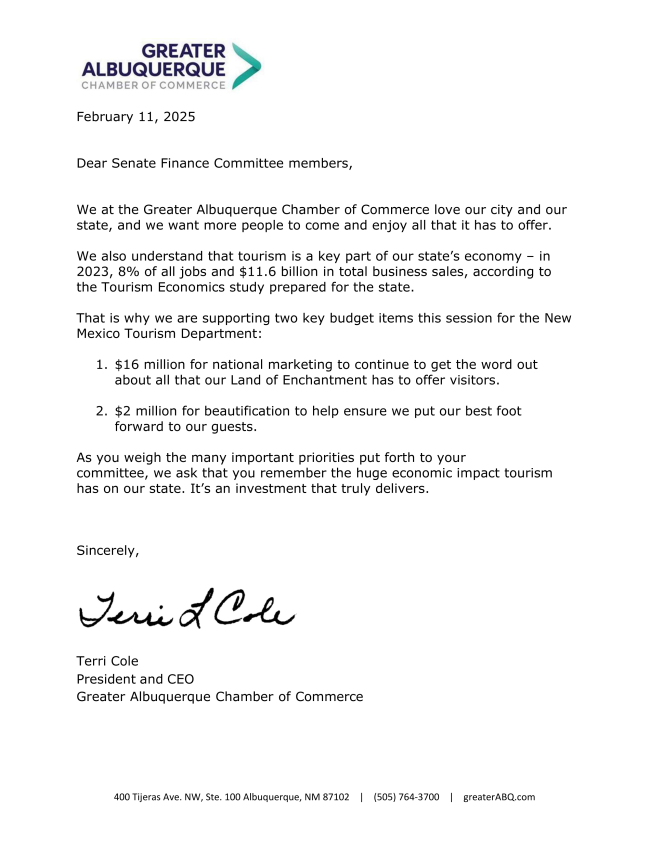

The Chamber supports our state’s tourism economy, and President and CEO Terri Cole sent this letter to the committee members laying out exactly why, as well as which projects are top priorities:

Acting Secretary Lancing Adams laid out that the vision of the department is to “be the primary destination for venturesome travelers” and the mission is to “grow New Mexico’s economy through tourism.” In response to Committee Chairman George Muñoz (D-Cibola, McKinley & San Juan)’s question of what attracts the most tourists, Lansing said that’s still the Albuquerque International Balloon Fiesta, along with Santa Fe and Taos, but the Air Races coming to Roswell promise to bring in 50,000 visitors.

Adams also shared efforts to market New Mexico nationally and internationally, to promote the New Mexico True-certified line of products (now at 470 partners!), and to get editorial features in earned media, such as a recent magazine feature in Nat Geo.

The 2023 numbers have tourism bringing in $8.6 billion in direct visitor spending and $810 million to the tax base, supporting 93,200 jobs and delivering $11.6 billion in total economic impact.

As Cole said, tourism is an investment in New Mexico that really delivers. We’ll be watching to see how the Tourism Department’s budget – and many others – fare in the session.

N.M. COULD LEAD THE COMPUTER WAY

So what’s this a picture of? Is it from the set of Star Wars? Maybe the insides of a missile guidance system? Good answers, but this is actually a peek at a quantum computer. A what? So here’s the layman’s explanation (that’s as good as we can do). These are supercomputers not using semiconductors like today’s computer but using tiny particles that can store and process information so fast that problems can be solved that lead to revolutionary discoveries. To give you an idea of how fast is fast, a conventional computer would take 720 trillion times the age of the universe to solve a problem that a quantum computer did in five minutes. Can you imagine the impact on mankind to have this kind of problem-solving capability?

Senate Bills 211 and 212, sponsored by Senate Majority Whip Michael Padilla (D-Bernalillo), would give tax breaks to keep New Mexico in a leadership position as this new technology, really a new economy, emerges. We missed the huge wave of the semiconductor revolution when Bill Gates moved to Seattle. We don’t want to miss this one. The Senate Tax and Business Committee is holding these two bills for consideration in the overall tax package to be developed later in the session.

Specifically, SB 211 would, according to the FIR: provide for “the quantum facility infrastructure income tax credit for individuals and the quantum facility infrastructure corporate income tax credit for corporations —to encourage investment in quantum technology infrastructure. Taxpayers who invest at least $3 million in qualified expenditures, such as land, rent, buildings, and infrastructure for quantum facilities, can receive a tax credit worth 30% of their investment, up to $50 million per facility. The total lifetime statewide cap for these credits is $75 million, increasing to $150 million if New Mexico receives a National Science Foundation award for quantum technologies.” Bottom line? This bill is about attracting capital investment.

J.D. Bullington had prepared testimony in support:

“Frankly speaking, trying to understand quantum physics and quantum computing is above my pay grade. What we do know is that New Mexico is well-positioned to be a national leader in this mind-boggling and exciting new frontier. Quantum computing could revolutionize computing capability that can lead to astonishing discoveries in, for example, cures for awful diseases like Alzheimers.

“This bill provides what really is a modest tax credit to help keep New Mexico as a leader of the pack. This leadership will contribute more than 10,000 new jobs and the education of as many as 30,000 workers. Already, the U.S. Department of Commerce has unlocked $127 million in federal and state funding that could drive as much as $2 billion in private capital investment in the Mountain West.

“New Mexico can claim a big slice of this pie if we lead. As you can see, there’s a lot at stake, and this bill simply seeks a relatively small tax credit. UNM and Sandia Labs have formed the New Mexico Quantum Institute at the university as a premier research facility. We’re really in this game – it’s exciting and the kind of advanced industry we so much need. Please vote yes on SB 211.”

There was absolutely no opposition either to this measure or SB 212 but plenty of support from our universities, national labs and private companies developing this technology. SB 212 focuses on GRT tax credits for building the equipment and support structures needed. Again, according to the FIR, the bill “establishes the quantum testing and evaluation gross receipts tax credit, allowing national laboratories in New Mexico to claim a tax credit against their state gross receipts tax liability for federally funded quantum research, testing, and device fabrication. The credit matches the amount of federal funds received, with a $15 million annual cap and a total aggregate $60 million cap through July 1, 2035.”

J.D. Bullington also prepared testimony on this bill:

“As we said in our testimony on SB 211, quantum computing is an exciting and revolutionary development of computing capacity, allowing for the fast processing of huge amounts of data. There’s a lot of work to do to bring the promise of this computing to life.

“New Mexico, in cooperation with Colorado, has formed a consortium recognized by the federal government as a national leader awarding a substantial grant. The GRT exemption sought in this bill has caps and time limits to constrain the impact on the general fund and is vital to attracting investment, training a new workforce and creating thousands of jobs. We’re at the point of inflection that decides whether we continue to lead – we missed Bill Gates and Microsoft – let’s don’t miss this opportunity. Please vote yes on SB 212.”

Of all the things we, as a state, spend money on, this surely should be at the top. It could transform New Mexico’s economy and contribute to national security as well. Let’s catch this wave!

TAX CREDIT BOOST FOR RURAL MEDICALPROVIDERS

GETS UNANIMOUS ‘DO-PASS’

This morning the House Rural Land Grants and Cultural Affairs Committee made headway in tackling our state’s shortage of medical professionals, giving a bipartisan 5-0 “do-pass” vote to House Bill 226, the Rural Health Care Practitioner Income Tax Credit, sponsored by Minority Whip Alan Martinez (R-Sandoval).

The Chamber was there in strong support of the bill, one of many the GACC believes are needed to get more doctors, nurses, therapists and other health care providers practicing in New Mexico.

D’Val Westphal, executive vice president of policy and programs for the Greater Albuquerque Chamber of Commerce, testified that:

“One of the big talking points this session has been the severe shortage of health care providers in our state, and rural New Mexico feels that shortage acutely.

“That’s why it’s important to increase the value of the rural health care practitioner tax credit – so we can attract, and keep, more physicians, dentists, psychologists, podiatric physicians, optometrists and other medical providers.

“Our amazing state is not the only one in great need of medical professionals – that’s why it’s going to take a whole bag of carrots to get the health care providers New Mexicans so desperately need to come to, and stay in, our state. This tax credit is an important one. We urge you to vote yes on HB 226. Thank you.”

Joining the Chamber is support were:

- The New Mexico Medical Society, which pointed out we are competing with Texas (no income tax) and Colorado (lower income tax) for medical professionals, and we need to do everything possible to be on par with them.

- The New Mexico Nursing Association and the New Mexico Nurse Practitioners Council, which said the current tax credit has improved the number of providers and the increase will do even more.

- The New Mexico Behavioral Health Provider Association.

- The Southwest Bone and Joint Institute in Silver City, which said the current tax credit is insufficient to retain and attract health care professionals. And

- The New Mexico Optometric Association, which said the increase will help attract more providers and keep those already here.

There was no opposition in public comment or on the committee. Both Reps. Jimmy G. Mason (R-Chaves, Eddy & Lea) and Catherine Cullen (R-Sandoval) commented that “every little bit we can do to support our doctors and nurses we need to do. … Whatever we can do.”

According to the bill’s Fiscal Impact Report, “HB 226 triples the value of the rural health care practitioner tax credit, increasing the credit from $5,000 to $15,000 for physicians, dentists, psychologists, podiatric physicians and optometrists and from $3,000 to $9,000 for many other types of medical practitioners practicing in rural areas.”

HB 226 is now headed to House Taxation and Revenue, where it could be included in the omnibus tax bill. We’ll keep you updated on it.

P3S: PUBLIC-PRIVATE PARTNERSHIPS ADVANCES

A majority of states throughout the United States allow state and local governments to partner with private businesses to complete public projects. It’s time to do that in New Mexico, and we’ve been trying for over a decade.

Rep. Patricia Lundstrom (D-McKinley) presented her bill, House Bill 276 Public-Private Partnerships Fund & Program, in the House Transportation Committee today. The legislation creates the “public-private partnership program” to be administered by the Local Government Division of the Department of Finance. The program is meant to evaluate and provide grants to fund transportation and broadband projects.

Enrique C. Knell spoke at this morning’s committee hearing on behalf of the Chamber of Commerce. He said, “P3’s will help us start and complete critical infrastructure projects throughout the state, and will help create and secure jobs along the way. In New Mexico, these partnerships will especially help our rural areas with critical projects like access to broadband, as well as repairs to bridges and highways.”

It doesn’t seem particularly controversial, as it passed this morning unanimously. In fact, the bill has passed several committees and even the entire House over the last few years. It always achieves a bipartisan, near-unanimous vote in that Chamber.

So why isn’t it law yet? The answer is somewhere in the Senate Judiciary Committee. The last two sessions, 2023 and 2024, the bill passed out of the House, went to the Senate, and has been assigned to Judiciary. At least in those two years, the bill hasn’t received a hearing in that committee and therefore just dies.

We feel it’s time to allow state and local governments to partner with private businesses to complete public projects. Thirty-six states, the District of Columbia and Puerto Rico have laws that allow P3s for certain projects. It varies by state.

We’ll keep an eye on this bill as it makes its way through the process. Will a Senate committee once again mark its end? We’ll let you know.

IN THE HOUSE

Acequia Day

Say the word “acequia” to a New Mexican, and it conjures images of families and neighbors working hard, of good food, of a nostalgic way of life dedicated to agriculture and cooperatively sharing water. Its roots are deep, going back to the 1500s when the art and skills of acequia construction and management were brought to this country. Moors in the Iberian Peninsula of Spain perfected the art now handed down to us centuries later.

Rep. Joseph Sanchez (D-Colfax, Mora, Rio Arriba, San Miguel and Taos) sponsored House Memorial 21 naming today as “Acequia Day.” Guests were introduced, and many legislators spoke about their personal memories of working and playing in acequias. Also, the centennial of the Middle Rio Grande Conservancy District was recognized. The celebrations concluded with also naming the day for “lowriders.” Several people brought lowriders to the Capitol to celebrate the occasion.

IN THE SENATE

Acequia Day 2.0

As in the House, the Senate also celebrated Acequia Day. Sen. Pete Campos (D-Colfax, Guadalupe, Harding, Mora, Quay, San Miguel & Taos) sponsored the resolution, which highlights the historical and cultural significance of acequias, their role in local agriculture and their contributions to the state’s economy. Campos said acequias have been a way of life for centuries in New Mexico — helping keep the agricultural industry strong. Campos pulled out a blue bandana — which he called la bandera de los trabajadores — which is often seen by workers in the fields to keep cool.

Celebrating Asphalt Paving Day

So believe it or not, we’re celebrating asphalt. It’s taken for granite (bad pun). Sen. David M. Gallegos (R-Eddy & Lea) introduced a resolution recognizing the economic and infrastructure contributions of the asphalt industry, including job creation and road maintenance. Sen. Michael Padilla (D-Bernalillo) also expressed his support for the asphalt industry and its role in New Mexico’s economy. “Asphalt is a safe way to travel the roads and is huge economic development for us,” Padilla said. “The folks that provide these jobs aren’t simply doing their work, they are beautifying their areas.”

JOINT SESSION OF THE HOUSE AND SENATE

Hispanic Culture Day Celebrated

Thanks to late Senate President Pro Tempore Bennie Altimirano, Hispanic Culture Day is an event everyone looks forward to each year. We’ve always liked the emphasis on the culture that so vividly enriches our state – the language, the art, the music, the traditions and the values.

Speaker Javier Martinez (D-Bernalillo) emphasized this in his comments. He spoke of the “tapestry” of Hispanic (and indigenous) culture, which emphasizes kindness, respect and “always having your back.” Senate Majority Whip Michael Padilla (D-Bernalillo) also spoke to the culture that emphasizes “locking arms and getting things done.” He estimates that 95% of the time people pull together to find solutions that work for the people.

Representatives of the National Hispanic Cultural Center (the only national center) pointed out that it’s been 25 years since the center was founded, providing a place for artists of various kinds to display their work on a national level. Moreover, the center has brought in world-class performers, and it serves as a resource for Hispanic history and genealogy. Hispanic leaders from around the state were introduced and recognized.

SIGNING OFF FROM SANTA FE

From oil and gas to quantum computing to strategic water supplies and more, it’s been quite a potpourri today. Bills are now reaching the floors of both Chambers. The Senate is back in session at 11 and the House at 10:30. The House Judiciary Committee is scheduled to roll out the public safety package tomorrow afternoon, and we can’t wait to see what’s in and what’s not. And, don’t forget, only two shopping days left until Valentine’s Day. Until tomorrow, have a great evening.