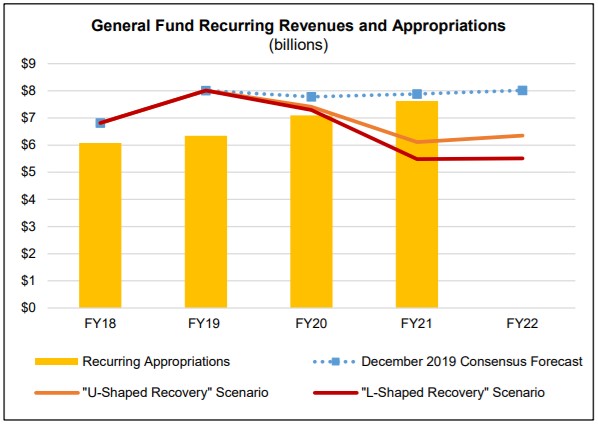

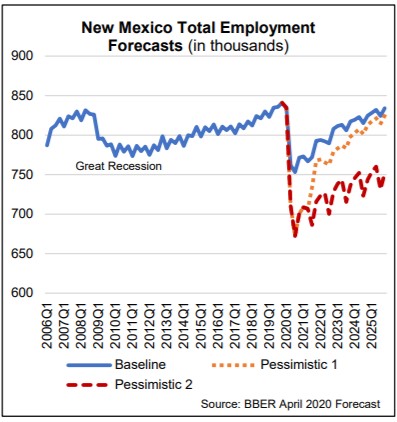

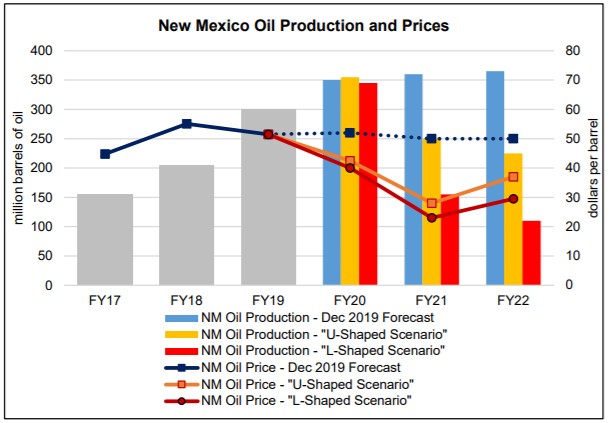

Weighed down by the double burden of a major decline in gross receipts taxes due to COVID-19 and a steep decline in global oil prices, New Mexico’s recurring revenues are expected to decline somewhere between $1.7 and $2.4 billion in FY2021, according to consensus revenue estimates released by the Governor’s office and state legislature last week.

Analysts mapped out both an optimistic “U-shaped” recovery in which economic activity and oil production rebounds to near pre-pandemic levels and a more pessimistic “L-shaped” projection where business activity and oil prices remain low and drive the state into a prolonged economic contraction. Even the more optimistic scenario envisions a decline in revenues of more than 20%, punching a major hole in a state budget that has seen substantial growth in recurring spending each of the last two years.

The staff economists from the Legislative Finance Committee, Taxation and Revenue Department, and Department of Finance and Administration conclude that:

“In both scenarios, widespread business closures and associated layoffs lead to significant declines in personal income tax and gross receipts tax (GRT) revenues. Low oil prices and declining production significantly reduce severance tax revenues, federal royalty payments, and GRT collections from drilling activity. Other revenues, including corporate income taxes, motor vehicle excise taxes, gaming receipts, and tribal revenue sharing, are also expected to decline.”

With a special session as early as mid-June looking all but certain, substantial spending cuts appear unavoidable, particularly since even the substantial reserves set aside in each of the last two legislative sessions are likely to be insufficient to cover revenue declines in FY20 and FY21. You can read the full consensus revenue memo here, and we will continue to keep members updated on the legislative response to the COVID-19 pandemic in the weeks and months ahead.