SPUR-OF-THE-MOMENT, $500M TAX INCREASE

SPUR-OF-THE-MOMENT, $500M TAX INCREASE

ROCKETS OUT OF COMMITTEE

Say what? Yep, the House Energy, Environment and Natural Resources Committee gave a 7-4 nod of approval to House Bill 548, sponsored by Reps. Nathan Small (D-Doña Ana) and Meredith Dixon (D-Bernalillo). This late-introduced bill (it was introduced right at the bill introduction deadline) seeks to impose a 25% tax increase on every barrel of oil produced on state lands, which would raise nearly a half a billion dollars in new state revenues. The new revenues would go to the general fund for more spending on state programs and projects, as if OVER THREE BILLION DOLLARS in new state revenue this year weren’t enough. As you can tell, we’re not really keen on this idea.

J.D. Bullington offered this testimony in opposition:

“As we all know so well, the oil and gas industry is contributing nearly half of general fund revenues, putting the state awash in cash. And, this cash is being invested in various trust funds, establishing a golden financial future for the state. A future where much of the general fund can be supported from interest earned on these funds. A future where funding for our children’s education is assured. A future where we can confidently navigate volatile economic times.

“Given this backdrop, it’s hard for us to support any tax increase on any entity. We have enough money and then some. Please vote no on HB 548.”

‘Punishment to an Out-of-Favor Industry’

That’s how the New Mexico Oil and Gas Association characterized HB 548. NMOGA made it absolutely clear this would change oil field economics (not in a good way), making it less attractive for investment and decreasing production and jobs. In fact, marginal production would likely shut down, lowering state revenues. The New Mexico Chamber of Commerce, the Santa Fe Chamber of Commerce and Armstrong Energy all stood in opposition – the number of speakers allowed were only three in the committee room and two online, but many people in the committee room raised their hands in opposition. The only support came from the Sierra Club.

Why is a Tax Increase Needed?

Reps. Rod Montoya (R-San Juan) and Mark Murphy (R-Chaves) hammered on this question repeatedly. The answer from Small is “making life more affordable for New Mexicans.” When pressed, Small said he was worried about federal cuts to Medicaid for which the state might have to make up, or maybe more tax reductions to working families, or maybe, as Murphy suggested, for paid family and medical leave. As we’ve reported, HB 11 (the paid family and medical leave bill) has no dedicated funding source for nearly $200 million of expenses. We think Murphy hit the nail on the head. This would explain why a johnny-come-lately bill is being rushed through the Legislature with zero stakeholder input and zero consideration by an interim committee that most always vets major tax proposals before they are introduced during a session.

Cuts to Medicaid may or may not occur, so it would be premature to enact a tax increase. As Gov. Michelle Lujan Grisham indicated yesterday, if the Medicaid cuts were to be made, she’d call a special session to deal with it. In the meantime, HB 548 could undergo interim committee investigation, giving stakeholders a chance to participate.

It’s a ‘Tweak’ … Just ‘Fine Tuning’

Another part of the answer simply is “because we can.” Small suggests this is a “tweak” or a “fine tuning” of the tax structure that will still have New Mexico in a favorable position versus other states. Murphy points out that production on federal lands (not subject to state taxes) is up 13% while production on state lands is down 9%. It just might be New Mexico’s rather hostile attitude toward the industry, thus the feeling by both Murphy and NMOGA that the tax is punitive. Murphy, himself in the oil production business, stated for his company, this tax would add over $900,000 in cost – that’s 25% of his annual payroll. That’s a huge financial impact that certainly must adversely affect investment, jobs or both.

Another drawback to this tax increase is that it increases dependence on oil and gas tax revenues, which can be volatile. The goal of the Legislative Finance Committee has been to reduce this dependence through diversifying New Mexico’s economy. As came up during the committee discussion, we should be investing in advanced energy, quantum technology and other promising areas for economic growth.

History Behind Proposal

HB 548 is titled the Oil and Gas Tax Equalization Act. Currently, the tax rate on natural gas is 4% and the tax on oil is 3.15%. The sponsors proposed to raise the rate to 4% on oil – thus the “equalization” terminology. How we got to this place is interesting and relevant to analyzing the impact of the bill. Seems like way back in late ’80’s, the federal government enacted a substantial tax credit for developing natural gas from “tight sand” formations.

It was a time when the prevailing thought was that the country was running out of natural gas (forecasts are sometimes way off the mark). The state decided to increase the natural gas tax rate in order to grab a little more money since the increase was much less than the value of the federal tax credit. That credit expired in 1993. Tight sand formations are prevalent in the San Juan basin, an area struggling economically with the closure of the San Juan Generating station and associated coal mine. Therefore, Montoya asked a very relevant question – why not decrease the natural gas rate back to the original rate in order to stimulate new gas production? The answer from Small is that it would cost the state treasury $100 million, and he wants to raise more tax revenue, not decrease it.

There’s such a thing as a rush to judgment, and this seems to us to fit into that to a “T.” There’s been no interim study and no stakeholder input. HB 548 should be slowed down and referred to the former while the latter is gathered. Right now, it’s a solution in search of a problem, a blank-check approach. It’s not good tax policy.

ANTI-O&G FRACKING BILL NARROWLY PASSES

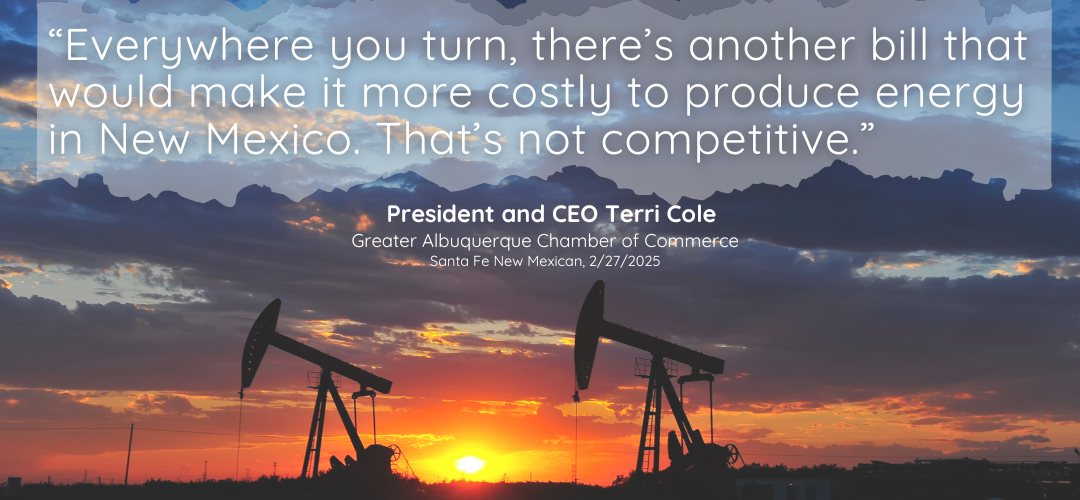

As Chamber President and CEO Terri Cole says, every time you turn around in Santa Fe, there’s a bill trying to make it harder, more expensive, less attractive to explore for oil or natural gas in our state. That’s despite the oil and gas industry fueling state coffers and rainy day funds for items like education, childcare and our universities.

Rep. Andrea Romero (D-Santa Fe) was once again in the House Energy and Natural Resources Committee to advocate for her legislation that would prohibit oil and gas producers from using per- and poly- fluoroalkyl — PFAS — in oil recovery. Rep. Romero’s expert witness for HB 222, Fracturing and Fluid Disclosure and Use: No PFAs”, was a representative from an environmental group known as Wild Earth Guardians. The bill passed 6-5 with one Democrat voting no. It heads next to the House Judiciary Committee.

J.D. Bullington told the committee why the Chamber opposes the bill:

“There are just too many uncertainties to make this legislation viable. First, the impact on production in our state is unknown. Secondly, there’s legal jeopardy, well-stated by the attorney general. Third, there’s rulemaking going on right now to address this subject that would be completely derailed if this bill passes.”

Rep. Jonathan Henry (R-Eddy, Chaves & Otero) brought up geothermal exploration and asked if it was included in the bill. Henry says it uses the same technology, including hydraulic fracking.

The sponsor responded that there is no expansion of oversight over geothermal exploration in her bill.

“Thank you, representative. I just find it interesting, that the only thing we’re concerned about in downhole operations and fracking is just oil and gas. … So I have an issue with only one industry having to comply when we don’t know what that other industry might be doing.”

Rep. Meredith Dixon (D-Bernalillo) joined with Republicans in voting “no.” Her concerns mirrored Henry’s.

“I think it’s well-intentioned. I have two concerns: No. 1 that OCD can compel the disclosure of that information already, and I think that Rep. Henry’s point about geothermal is extremely important.”

Gov. Michelle Lujan Grisham’s Energy, Minerals and Natural Resources Department expressed concerns on HB 222 in a written analysis.

“EMNRD notes House Bill 222’s impact on operators, trade secrets materials, and the use of them in operations has the potential to either simply incentivize operators to not use trade secret material in the state, which could potentially impact effective operations, or incentivize the industry to move to states that do allow for use of trade secret materials. EMNRD analysis notes either instance could impact state revenues.”

We’ll leave you with final words from ENMRD, the state entity responsible for regulating oil and gas exploration in our state. Its officials wrote that HB 222 could “create a chilling effect for (oil and natural gas) development in the state.”

‘THE FUTURE AIN’T WHAT IT USED TO BE’

– YOGI BERRA

Ain’t it so. And going back to the future ain’t going to fix what ails our school system. In our view, that’s exactly what Senate Joint Resolution 3, sponsored by Sen. Bill Soules (D-Doña Ana) would accomplish. It would put back in place a system rejected by voters in 2003, namely an elected state board of education with 11 total members, 10 of which are elected and one of which is appointed by the governor for a term that corresponds with the governor’s same term. The bill passed the Senate Finance Committee today on a 7-3 vote. All three “no” votes were cast by Democrats. We’ve said it many times before, and we’ll say it again: the governance structure isn’t the problem – the lack of focus on reading and math and student performance is.

Chamber Position

This is how Terri Cole, president and CEO of the Chamber, states it:

“By creating a large, 11-person board to oversee public education – two-thirds of whom would run for elections to their positions – this legislation would inject an incredible amount of politics into public education… and that’s the last thing we need.

“School boards across America are under fire for being hotbeds of political chaos, division and acrimony. They routinely lose focus on student needs and outcomes. Why would we invite a similar situation at the state level?

“Please recall that New Mexico once put an elected body in charge of utility regulation in our state – and we ended up with a daily cocktail of dysfunction and poor decision-making. Rightly so, we retreated from that model.

“The number of adult decision-makers is not driving students’ unacceptably low academic performance in New Mexico. This resolution is not going to fix what’s broken. Let’s not advance a so-called solution that hasn’t worked before and won’t again.”

Committee Discussion

Sen. Linda Trujillo (D-Santa Fe) thinks that how governance of public education is structured needs a lot more study and discussion. She opposed SJR 3 because, in her view, it added another layer of bureaucracy between the Legislature and the Public Education Department. She pointed out that there have been two different structures used, and student achievement has been poor under both.

Soules believes that’s because of other societal issues, namely poverty. While that may continue to be a factor, many legislators have been pointing to recent actions that have moved childhood poverty levels from last to 17th in the nation. The state has increased spending on public education exponentially without moving the needle. It’s fundamental – we’re not teaching children what they need to be successful – namely reading and math (both Soules and Senate Pro Tempore Mimi Steward (D-Bernalillo) have bills addressing those very subjects).

That’s the focus that’s needed. Mississippi did just that and boosted its education achievement from last to top 20. It certainly has as many issues with poverty as we do but found that modern teaching of reading, for example, helps children regardless of language challenges or income status – every child can learn to read. The obvious solution to poverty is to empower children to learn, go on to higher education and succeed in the world.

Sen. George Muñoz, (D-Cibola, McKinley & San Juan) committee chair and one who voted against SJR 3, expressed his concern that the elected seats would be dominated by union money electing candidates friendly to union desires. It’s very likely that these seats go relatively unnoticed by voters. They’re likely to be “down ballot,” attracting about as much attention as voting for judges – who knows, right? That is an open invitation for undue influence to be applied by any side or faction.

To end where we started with Yogi wisdom, you’ll also remember a quote often attributed to him, “It ain’t over until the fat lady sings.” Nope. Next stop for SJR 3 is the Senate floor and, if passed by the Senate, over to the House.

HERE’S A CONCEPT: POLICE OFFICERS GET SAME VICTIMS RIGHTS AS THE REST OF US

Under the category of “who knew” or “are you serious?” comes the fact that police officers, if killed or injured, don’t have the same victims rights as all the rest of us. Rep. Andrea Reeb (R-Chaves, Curry and Roosevelt), a career prosecutor, wants to change that through House Bill 104 that sailed through the House today on a vote of 57-6. The bill would include police officers and their families in the victims rights statute which provides 12 specific rights, including being notified of court or sentencing hearings; participating in the hearings, getting workers compensation, applying for counseling for themselves or family, etc. The bill doesn’t impact the crime victims reparations fund. Good for you Rep. Reeb! We need to take care of the ones who protect us.

EFFORT TO IMPROVE SPECIAL EDUCATION

SAILS THROUGH THE SENATE TO HOUSE

A former special education teacher stood up in the Senate today and presented her bill to improve special education statewide. Senate President Pro Tempore Mimi Stewart (D-Bernalillo) taught special ed at Zia Elementary School in Albuquerque. Today she presented Senate Bill 38, Special Education Act, on the Senate floor and fielded questions from fellow senators.

Her bill ultimately passed 31-7 and heads to the House now.

Stewart has explained the bill codifies the governor’s executive order on special education from several years ago along with subsequent legislation to “ensure we have the right people working on these issues.”

The bill formally creates the Office of Special Education (OSE) within the Public Education Department. It will help provide a uniform standard of education for special ed students no matter what district they attend. Under SB 38 OSE will create a standard Individualized Education Plan (IEP) that can be used statewide. That makes it easier when students move from one school or district to another. The OSE will also train school boards and governing bodies, school administrators, and school personnel on specific topics related to the education of differently-abled students. They also plan training for teachers and parents.

In committees, several superintendents stood and opposed the bill, saying it was overregulation and unnecessary.

Sen. Larry Scott (R-Chaves, Eddy & Lea) questioned Stewart about the opposition from our school’s front-line leaders, “I, too, believe that some 90% of the school superintendents are standing in opposition to this piece of legislation, and I’m curious as to why that circumstance exists. Was this an unfunded mandate? Do they feel like they have too many bosses coming from Santa Fe? Could you flesh out a little bit what the source of those objections were, if you know them?”

Stewart explained that Gov. Michele Lujan Grisham, a supporter of this bill, had said a few things about the Senate Education Committee members, and many in the education field were insulted. “The superintendents overreacted, and that it was just one person not 90% of them, so I think they’ve calmed down, they were trying to support the education committee (so) they stood up and said they’re not going to support anything that she (Governor Lujan Grisham) wanted,” Stewart told Scott.

Scott remained unconvinced and ultimately voted against Stewart’s bill, saying “I do listen to all of my superintendents, because I believe without exception that they are dedicated educators, and for the most part, know what they’re doing.”

“I’ve talked to three or four other superintendents, the Rio Rancho superintendent, Roswell superintendent, over the last weeks. None of them brought up any of these questions,” Stewart told Scott and the Chamber. “So I think it’s kind of a myth… I think this is very important moving forward. We’ve had issues with special ed for years. I do not think that this is the way to solve it.”

Sen. Angel Charley (D-Bernalillo, Cibola, McKinley, Socorro, & Valencia) stood in support of Stewart’s bill and shared her own experience with her local school district.

“I’m the parent of a special needs child. They’re actually in the Gifted and Talented program and have had an IEP since elementary. And in my child’s high school journey, they’ve been to three high schools. And so I really appreciate the intention of this legislation because it helps parents support the child that they have. At every single one of these high schools. I have had to fight for my child to have the accommodations that I know they need.”

AROUND THE ROUNDHOUSE

Special Session? Gov. hints at possibility in October

On Wednesday, the Greater Albuquerque Chamber of Commerce hosted the Governor’s Mid-Session Report to the Business Community at the Sheraton Albuquerque Uptown.

Gov. Michelle Lujan Grisham began her speech by saying she made everybody nervous when she called the special session last July to tackle public safety and crime. “I have, in fact, called many special sessions,” Lujan Grisham said. “… In the two years that are left, we’re going to have more. That’s not a threat or challenge. When you have such wild swings at the federal level, states have to be in a position to respond to any number of things. I’m predicting right now, when the federal budget, whenever that is, occurs, we’re going to need a special session by October just to deal with health care and to keep our rural hospitals open.”

Gov. signs crime package, behavioral health bills into law

With her long signature, Gov. Michelle Lujan Grisham, center, signs three bills into law Thursday.

On Thursday, Gov. Michelle Lujan Grisham put pen to paper and signed three public safety and behavioral health bills into law.

It was last July when the governor called a special session to address crime and public safety. The Legislature was unresponsive. However, calling the special session shines a bright light on the need for action.

.Six months later, Lujan Grisham praised both sides of the aisle in creating and getting her legislation. “Thank you to this body of leaders who have been working diligently and to the families and the advocates and victims,” she said. “You’ve been waiting for justice. Thank you from the bottom of my heart for putting New Mexicans’ public safety first. This is a monumental achievement, and I’m grateful for this legislative body and the leadership in the House and Senate.”

The governor signed House Bill 8, a public safety omnibus package sponsored by Reps. Christine Chandler (D-Los Alamos, Sandoval & Santa Fe), Joy Garratt (D-Bernalillo), Cynthia Borrego (D-Bernalillo), Kathleen Cates (D-Bernalillo & Sandoval) and Charlotte Little (D-Bernalillo). HB 8 is a comprehensive public safety package addressing multiple areas of concern:

- Criminal competency reform – Addresses over 18,000 criminal charges dismissed since 2017 due to competency issues by creating a community-based restoration program for non-violent offenders and requiring secure facility commitment for violent non-competent defendants.

- Weapon conversion devices – Criminalizes possession of weapon conversion devices or “Glock Switches,” targeting rising juvenile gun crimes.

- Shooting threats – Elevates the penalty for threatening to shoot a person, group, or public space from a misdemeanor to a fourth-degree felony, allowing courts to order restitution for economic harm caused by threats.

- Fentanyl trafficking – Establishes graduated penalties for trafficking based on quantity, with specific enhancements for larger amounts and for those organizing trafficking operations.

- Auto-theft penalties – Increases penalties for repeat offenders with a graduated system that elevates charges for subsequent offenses.

- DWI blood testing – Permits warrant-based blood draws for misdemeanor investigations and expands testing beyond alcohol to include other drugs.

While the Chamber actively advocated for passage of HB 8, we also don’t think the job is done. We’ve outlined additional steps that need to be taken, including a major overhaul of laws dealing with juvenile violent crime, the fastest-growing category of crime.

Also on Thursday, the governor signed two major behavioral health bills:

- Senate Bill 1: Behavioral Health Trust Fund, sponsored by Sens. George K. Muñoz (D-Cibola, McKinley & San Juan), Elizabeth “Liz” Stefanics (D-San Miguel, Santa Fe, Torrance & Valencia), Pat Woods (R-Curry, Harding, Quay & Union), Jay C. Block (R-Bernalillo & Sandoval and Rep. Dayan Hochman-Vigil (D-Bernalillo). It establishes a dedicated trust fund to provide sustainable, long-term financing for behavioral health programs across the state. The fund will support mental health and substance use treatment, prevention programs, infrastructure development and workforce expansion, with administration by the Health Care Authority under legislative oversight.

- Senate Bill 3: Behavioral Health Reform and Investment Act sponsored by Majority Floor Leader Sens. Peter Wirth (D-Santa Fe), President Pro Tempore Mimi Stewart (D-Bernalillo), Minority Floor Leader William Sharer (R-San Juan), Block, and Hochman-Vigil. It creates a behavioral health executive committee to coordinate statewide reform efforts through a regionalized approach based on local needs assessments. The act streamlines administration for Medicaid providers, builds a behavioral health workforce pipeline, requires regular service gap assessments, and ensures accountability through monitoring and evaluation.

The Chamber has also advocated for these measures as well as Senate Bill 2, which has specific appropriations to jump start the new system. Those appropriations are now included in House Bill 2, the budget bill.

GRT Is a Real Problem for Health Care Providers

It’s getting close to the time when tax committees in both the House and Senate will be putting together what’s referred to as “omnibus tax packages,” translated as a whole bunch of tax-related bills stuffed into one big bill – kind of like a burrito grande. Think New Mexico, a high-quality public policy institute, reminds us there are some very important bills that should be in that burrito. We support their viewpoint 100%. First, they identify GRT on medical services as a major factor driving doctors to retire early or leave our state.

New Mexico is one of only two states that impose a gross receipts tax (GRT) on the medical services. The other is Hawaii, and that state’s tax is capped at 4.7%. New Mexico’s GRT averages 7.05% and exceeds 8% in many parts of the state. Unlike most businesses, which simply pass on the GRT to their customers, medical providers cannot pass the tax on to insurance companies, Medicaid or Medicare. As a result, doctors, dentists and other health care providers end up bearing the full burden of the tax, making it more expensive to practice medicine in New Mexico than in other states. House Bill 344 and Senate Bill 295 would fully repeal New Mexico’s gross receipts tax (GRT) on medical services.

The Chamber also joins Think New Mexico in seeing a need to expand the Rural Health Care Practitioner Tax Credit. House Bill 52 would include EMTs, paramedics, occupational therapists, audiologists, speech and language pathologists and licensed practical nurses, among others. The shortage of these providers in New Mexico’s rural communities is even more severe than in our urban areas, and this tax credit helps encourage practitioners to serve patients in rural areas.

To increase the number of health care practitioners in our state, many steps need to be taken, but these bills are key parts to the overall solution.

A Guide To Speaking Legislature-ese

There’s no question every group – from a federal agency down to a youth sports league – has a jargon that insiders use, and the New Mexico Legislature is no different. When you consider the breadth and depth of what is tackled on those four floors in compressed amounts of time, it’s no wonder there’s a shorthand, so to speak.

But if you aren’t knee-deep in interim committees or tracking committee substitutes, you can get lost in the lingo. (FYI interim committees meet outside of the annual legislative session; committee substitutes are revised versions of bills introduced in committee hearings – see what we mean?)

The folks behind the scenes at the Legislature get this, and they’ve compiled handy guides to committee procedures and a full list of abbreviations. Below are some of the standard procedures and terms you’ll see in the Chamber’s RoundUp nightly:

Standing committees – Considered the workhorses in both houses during a session, the names of these committees are the best indicators of the subject matter they deal with (Education, Energy, Judiciary, Tax, etc.). The House has 14; the Senate has nine.

Interim committees – These operate in the period between the adjournment of one Legislature and the convening of another, or between sessions of the same Legislature. There are 23, and each one includes both House and Senate members.

Referral – When a bill is introduced in either chamber of the Legislature, it is almost always sent to one or more standing committees of that chamber. This procedure of sending a bill to a committee is called “referral.” Senate rules state that the senator introducing the bill must attach a note to the bill indicating to which committee or committees it should be referred. If any member in the Senate objects, the whole Senate must decide the question. In the case of bills coming over from the House, the rules provide for the whole Senate to make the referral. Actually, the referral is made by the Senate leaders, usually acting through the majority leader. In the House, the speaker has the sole authority to refer bills to a committee or committees, whether or not they originated in the House. If the bill contains an appropriation or requires the expenditure of public money, the rules of both the House and Senate provide that it be referred, in the case of the House, to the Appropriations and Finance Committee and, in the case of the Senate, to the Finance Committee.

Amendments – Since a committee has only the power of recommendation, it cannot actually amend or modify a proposal for legislation referred to it. It can only recommend amendments to the proposal, and these amendments are not effective until the legislative body adopts them. There is no limit to the number of amendments the committee can recommend for a bill as long as they are germane to the original purpose of the bill. However, if there are a great number of amendments proposed by the committee, a committee substitute for the original bill puts them all in one place and makes it easier to read and understand.

Substitute Bills – Substitutes may be made for any bill, resolution or memorial before it is enrolled and engrossed whenever it is open to amendment. When a substitute bill, resolution or memorial is adopted, it takes the place of the original, and the substitute itself is open to amendment. Since the committee substitute (CS) is technically considered an amendment to the bill, the subject matter of the substitute must be relevant to the title and subject matter of the original bill.

Committee Actions – Several courses of action are available to a committee on a piece of legislation referred to it:

- If the committee is in favor of the legislation as it was referred, it may recommend in its report that the legislation “do pass” (DP).

- If the committee is in favor of the legislation as a whole but deems it necessary to recommend amendments to certain sections, it may recommend that the legislation “do pass, as amended” (DP/a) and attach the proposed amendments.

- If the committee does not approve of the proposed legislation, it may recommend that the legislation “do not pass” (DNP).

- If the committee does not approve of the proposed legislation in the form in which it was referred to the committee, but feels that legislation ought to be enacted covering the same subject matter proposed in the bill, it may recommend that the proposed legislation “do not pass”, but that a substitute as drawn by the committee “do pass”. (DP/CS)

- If the committee does not wish to make any recommendation upon a legislative proposal, it may make a report “without recommendation” (w/o rec). This type of report is frequently used in those cases where the committee is in disagreement on a bill.

- If the committee chooses simply not to report a bill out of committee (i.e. “table”), it may do so (TBLD INDEF). This technique is not generally recommended by parliamentary and legislative authorities, who believe that the entire body should be given the opportunity to adopt or reject proposed legislation, but it is an effective device for filtering out unwanted or unneeded proposals.

Governor’s Actions – The governor has three days to act on legislation passed during the session (SGND Mar.4 Ch.9 = Signed by the governor, date and chapter number. VETO Mar.4 = vetoed by the governor and date). If she doesn’t act within three days, the bill becomes law. This changes during the last three days of the session, when the governor has 20 days to act, and no action becomes a pocket veto.

Enrolling and Engrossing – In New Mexico, the terms “enrolling” and “engrossing” are used jointly to describe the preparation of the final authoritative copy of a bill passed by both houses of the Legislature.

Want to know more? The Legislature has the Committee Handbook here, and a full list of abbreviations here so you, too, can understand what’s going on and talk like a Roundhouse veteran!

SIGNING OFF FROM SANTA FE

We’re still shaking our heads…a half-a-billion-dollar tax increase at the last minute? Nobody, no entity, no where, no how should have a tax increase, period. If the Legislature wants to do something different, then reshuffle the deck and reprioritize. They have more than enough money if properly utilized. Mama mia. And to try to take it out of the hide of the oil and gas industry? Oy vey. Enough said (until we say some more about it later). Committees and floor sessions tomorrow and likely on Saturday as well. We’ll bring you all the news and views. In the meantime, thanks for joining us and good night.